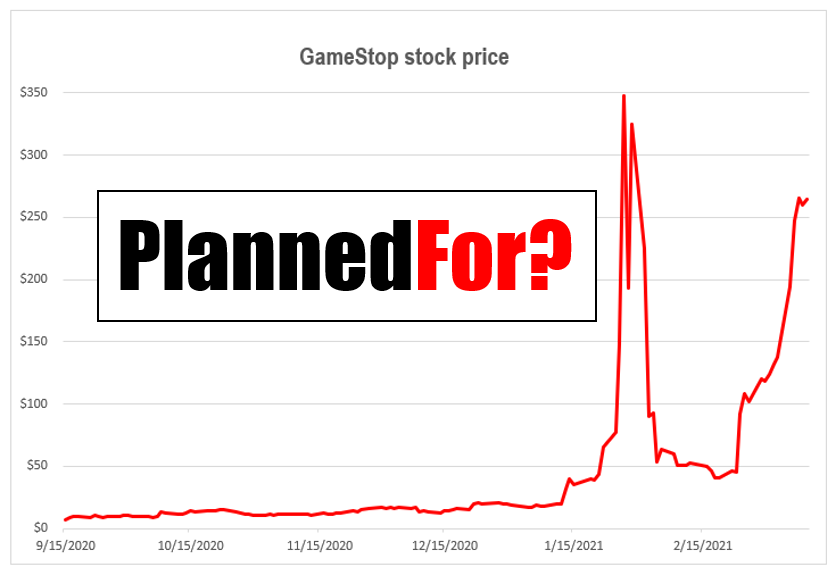

The GameStop stock frenzy seemed like a flash-in-the-pan but then, last week, it was reinvigorated. What Lessons Found can business owners and CEOs gain from it?

“[The last week of January] was the week when a bunch of amateur traders made Wall Street’s finest look like idiots.” This is the opening sentence for one report on GameStop’s stock 500% runup. By now, we have all heard this tale and its consequences including billions lost; a rushed investment to save Robin Hood; Robin Hood’s freezing trades of the stock and the call for congressional hearings. The resulting panic and lack of a coordinated response indicate that few considered the possibility of a social media driven stock run – let alone how to address it. But should regulators, Robin Hood, and hedge funds caught-short been better prepared? At least one Wall Street Journal columnist thought so: “This movement is the culmination of nearly five decades of the democratization of markets set off [by the launch of low-cost investment options]”.

How would 2020 have been different had you done contingency planning?

Imagine how Robin Hood’s and the short traders’ reaction would have been different had they considered the possibility of a social media inspired run on stocks. Now consider this scenario as a Lesson Found for your own business. How would this past year been different for you and your company had you considered, let alone planned for, the possibility of a widespread SARS-like infection, push to virtual work, supply chain issues, etc.? These events illustrate the value of contingency planning. Contingency planning starts with asking questions: What possible scenarios could negatively impact your company? What is the likelihood of an event? What would you need to do to ensure the continuity of your business in these situations?

As you go through this exercise, dig deep to think about the unthinkable. Specifically, what would happen if you, the CEO and/or owner, were to be incapacitated? This is incredibly more important in small, closely-held companies where the leader often fills many different roles and is the glue that holds the business together. Consider contingency planning as buying insurance: Planning for this contingency is planning on how to protect your employees’ livelihoods, your family’s future, and your legacy. And there is another advantage: Putting in place the systems and procedures in the event of this contingency becomes a reality increases the company’s value as well as sets the foundation for growth.

Contemplating and planning for negative scenarios is uncomfortable and burdensome. This makes it all the harder to achieve the mindset needed to consider the possibilities. Group brainstorming is a solution. At your annual staff gathering to share your plans for the future (which you should be doing anyway), ask your team to help protect that future by thinking about what unexpected events could block that vision. Another option is to work through this exercise with other CEOs and owners who share your understanding of the potential consequences involved. The most important thing is to start contingency planning to protect your business, your employees, your family and yourself.

Interested in learning more about contingency planning or how working with your CEO/owner peers can protect and grow your business? Reach out to set up your no obligation initial consultation. Connect with me either by phone (717-439-6254), text or email (mark@strategicbizgroup.com).