In a previous blog, I pointed out how Succession Plans are insurance for when the unexpected results in the business owner’s absence. The most common response to this I hear from business owners is: “Yes, but that’s not likely to happen to me.” While that may or may not be true, owners also need to ask themselves: “Can my business and my family afford the consequences if the unexpected happens?” Others’ experiences and the research provide a clear answer.

Business Longevity Insurance: Succession Plans

You have insurance to protect your business in case of fire, theft, and accident. So, why would you leave the future of your business to chance? That is what you are doing if you do not have an up-to-date Succession Plan. I have too often talked to business owners who are ready to cash out but cannot because they do not have anyone prepared to takeover or could not get the price they were expecting for their business. This article shows how a well thought out Succession Plan addresses these issues and much more. Employee Retention: According to a PricewaterhouseCooper study, voluntary turnover is on the rise and even higher for

Will your plans protect your company from Petering-out?

My son and I started watching Game of Thrones; him for the second time and this is my initiation. After GOT’s disastrous season 8, my son asked if I wanted to watch that final season. That is where this Lesson Found begins.

Succession Planning Takes a Team

I was surprised recently when someone mentioned they saw my role in the succession planning process as duplicative to that of attorneys. Using client examples, I provided a clearer understanding of how my role as a management consultant and family business advisor differed from and, in fact, eased the process for attorneys. Still, this prompted me to realize a review of the roles different professionals play in succession planning could benefit owners who have not yet begun their planning process. To that end, below are listed a few of the key steps in the succession planning process along with the professionals most likely to assist in that step.

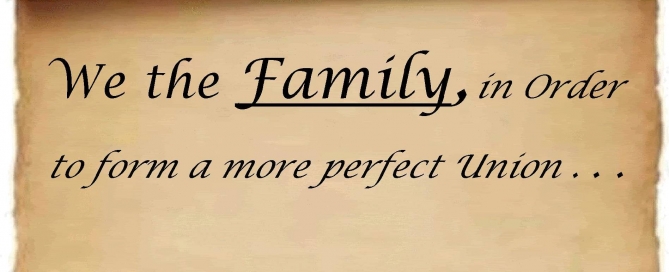

Governance Policies: A Family Constitution

Imagine our country without a Constitution. Our founding fathers had the foresight to codify a basic framework of beliefs and laws in the form of the Constitution of the United States. Our Constitution continues to provide structure and unite us even in these times. Every family owned business should take inspiration

Overcoming Barriers to Succession Planning

Family businesses are on the threshold of a historic transition. As of a 2007 study, the median age of top executives in family businesses was 50 years old and 40% of them expected to retire by 2017. Baby Boomer owners are relinquishing the reins of their companies. So you would expect businesses everywhere to have succession plans in place or to be deep into the planning process. Yet,