I was surprised recently when someone mentioned they saw my role in the succession planning process as duplicative to that of attorneys. Using client examples, I provided a clearer understanding of how my role as a management consultant and family business advisor differed from and, in fact, eased the process for attorneys. Still, this prompted me to realize a review of the roles different professionals play in succession planning could benefit owners who have not yet begun their planning process.

To that end, below are listed a few of the key steps in the succession planning process along with the professionals most likely to assist in that step.

Retirement & Estate Planning: While a comfortable retirement and protecting their legacy is the ultimate goal for owners, this is the first topic of conversation in the planning process. Naturally this conversation involves a financial adviser and, eventually, an attorney and accountant who offer advice on how to best protect wealth for retirement and as it is passed down to subsequent generations.

Documenting the Plan: The attorney creates the final product which formalizes the plan into legally binding documents such as buy/sell agreements, partnership agreements and/or articles of incorporation. The input into these documents comes from the conversations which, as noted below, an experienced consultant can facilitate.

Business Planning: As noted in a previous blog, successful succession plans consider how the business will anticipate and address future shifts in the market and economy. This answers the questions of what the business will look like and, if the number of shareholders is expected to increase, how the business will support the growing next generation. In this phase, the owners work with a business consultant to use techniques such as a SWOT analysis to consider the alternatives. Once identified, the addition of the owners’ accountant aides in fleshing out the feasibility of these alternatives through a thorough examination of current and forecasted financial statements.

Starting the Conversation: For a number of reasons noted previously, this is often the most difficult step to begin as well as see through to completion. It is also the most critical step since the results from these conversations will provide the very foundation for the rest of the succession planning process. Topics to be discussed are many and include sensitive issues such as who will succeed the current leader(s), how and when to transfer ownership shares and future decision making processes. Lack of consensus on these and similarly delicate topics increases the potential for misunderstandings which threaten the future viability of the business and, worse, can tear the family apart.

Given the importance and often emotional history of these topics, families and long-time business partners attempts to hold these conversations just among themselves can be precarious. A skilled consultant or advisor can facilitate the conversation and smooth out the emotions. With my clients, I have found a consultant’s personal experience in his own family business provides a perspective that engenders trust as well as keeps the conversation focused on the future of the business rather than personal issues rooted in the past.

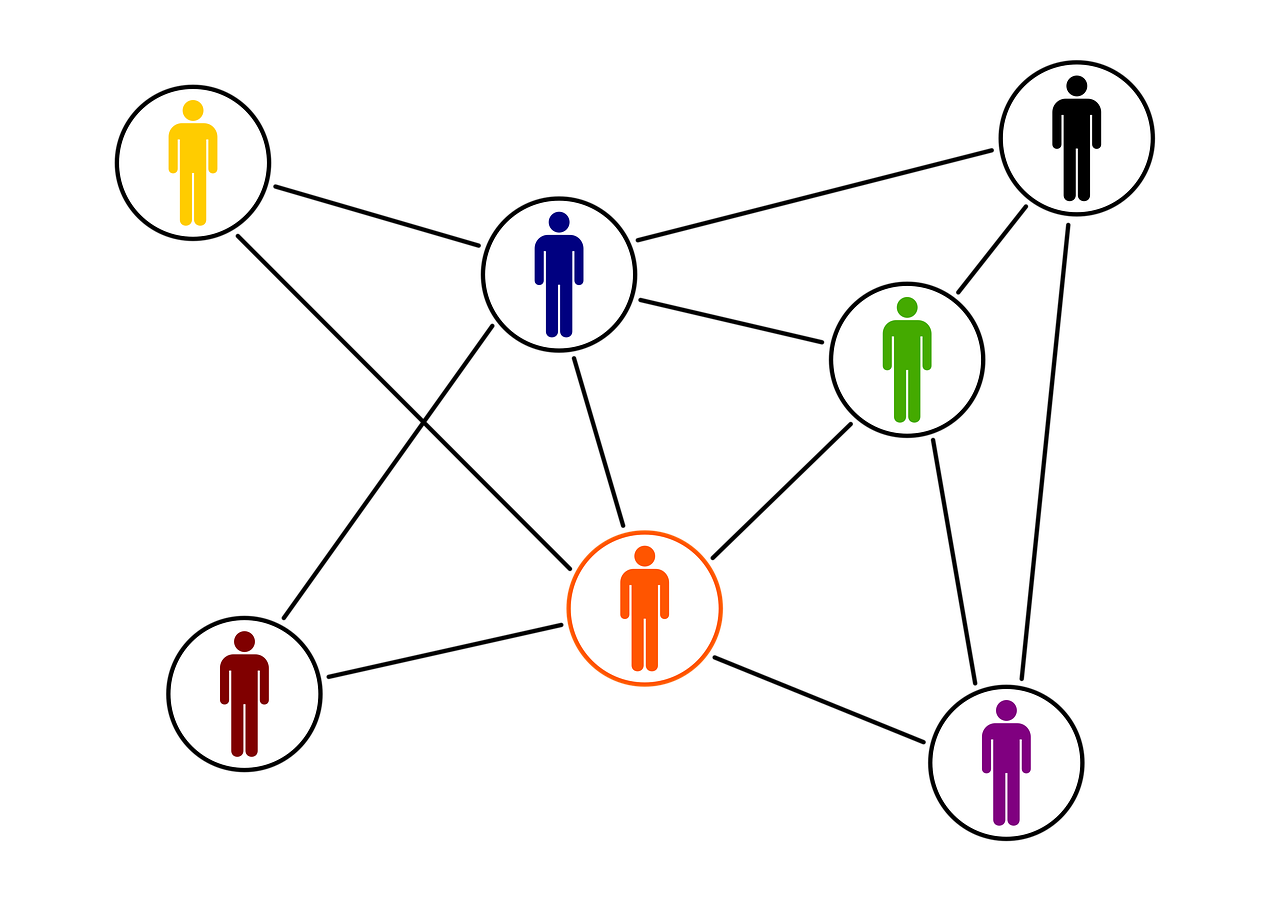

Clearly, it takes a team to create a succession plan which will protect the business in the short term and maximize profits over time. This team includes the business’s stakeholders working together and in close collaboration with skilled and experienced professionals they can trust.